Payroll. Sounds simple, right? Just pay your team on time and everything’s good. But as your team grows and compliance rules pile up, even the tiniest mistake can cause big trouble.

Just last week, I had lunch with our finance head, and we exchanged views on how fast technology is reshaping everyday operations. She shared something that hit close to home. One of our team members didn’t receive her salary before a long weekend. Naturally, she was stressed. Turns out, someone had missed a single row in a spreadsheet. Just like that, her pay got delayed. The team ended up working through the weekend to fix the error and send out apologies, all because of a simple manual mistake.

While they were sorting things out, someone on the team finally asked, “Can’t we just automate payroll?”

That single question led to a complete shift in how they handled things. And it’s not just their team. More and more businesses are moving toward automation. Because manual payroll is slow, risky, and it doesn’t scale.

In this blog, we’ll walk you through why switching to an automated payroll system makes sense, and how it can save your business time, money, and stress.

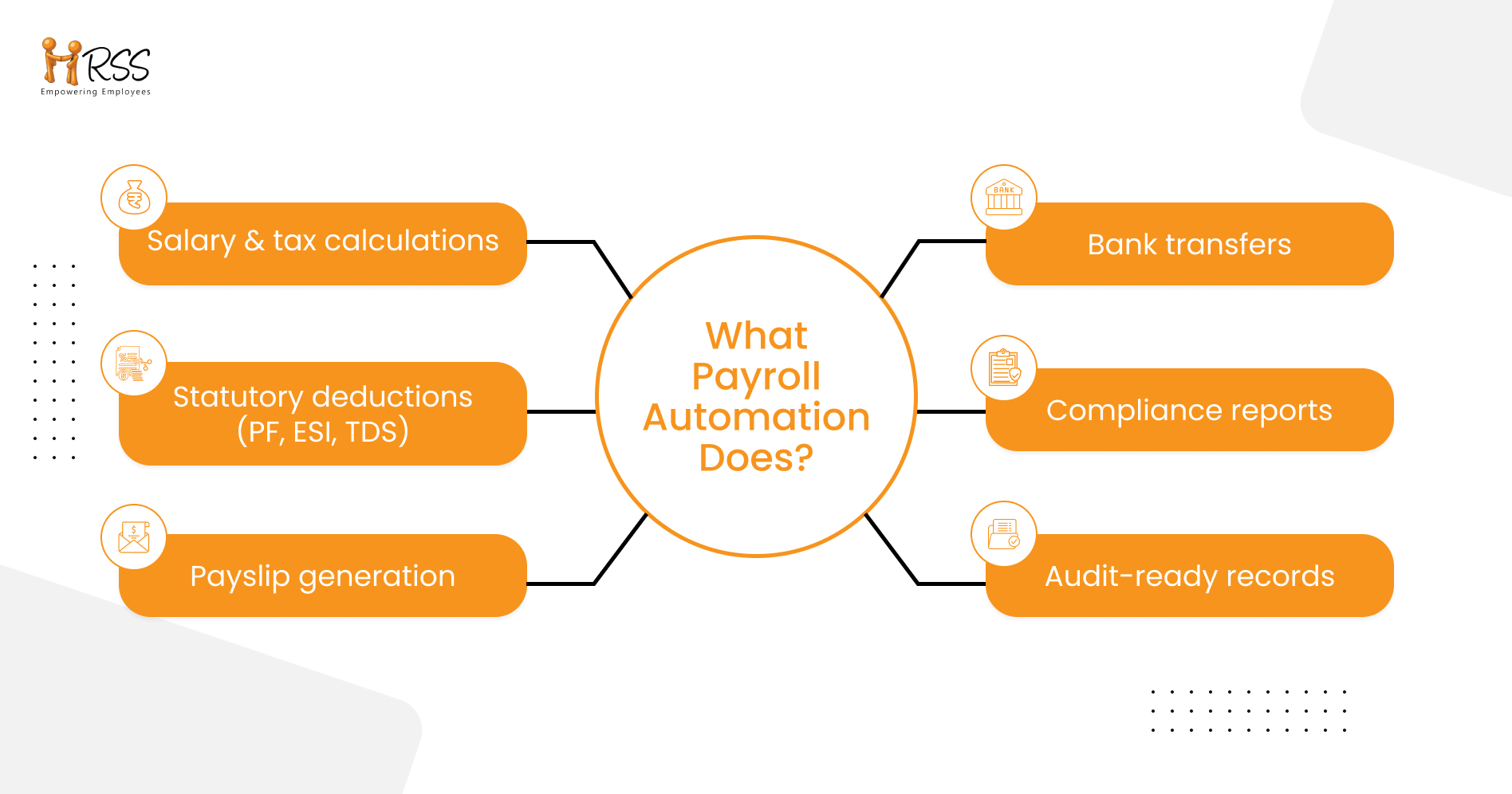

What is Payroll Automation?

Payroll automation uses software to manage all your payroll tasks. From salary calculations to tax deductions, from payslip generation to direct transfers, it takes care of everything.

Instead of manually inputting data every month, you enter it once, and the system does the rest.

A good, automated payroll system can handle:

- Salary and tax calculations

- Statutory deductions (PF, ESI, TDS, PT)

- Pay slip generation and distribution

- Direct bank transfers

- Compliance reporting

- Record-keeping for audits

And the best part? You’re no longer buried in spreadsheets or chasing last-minute approvals.

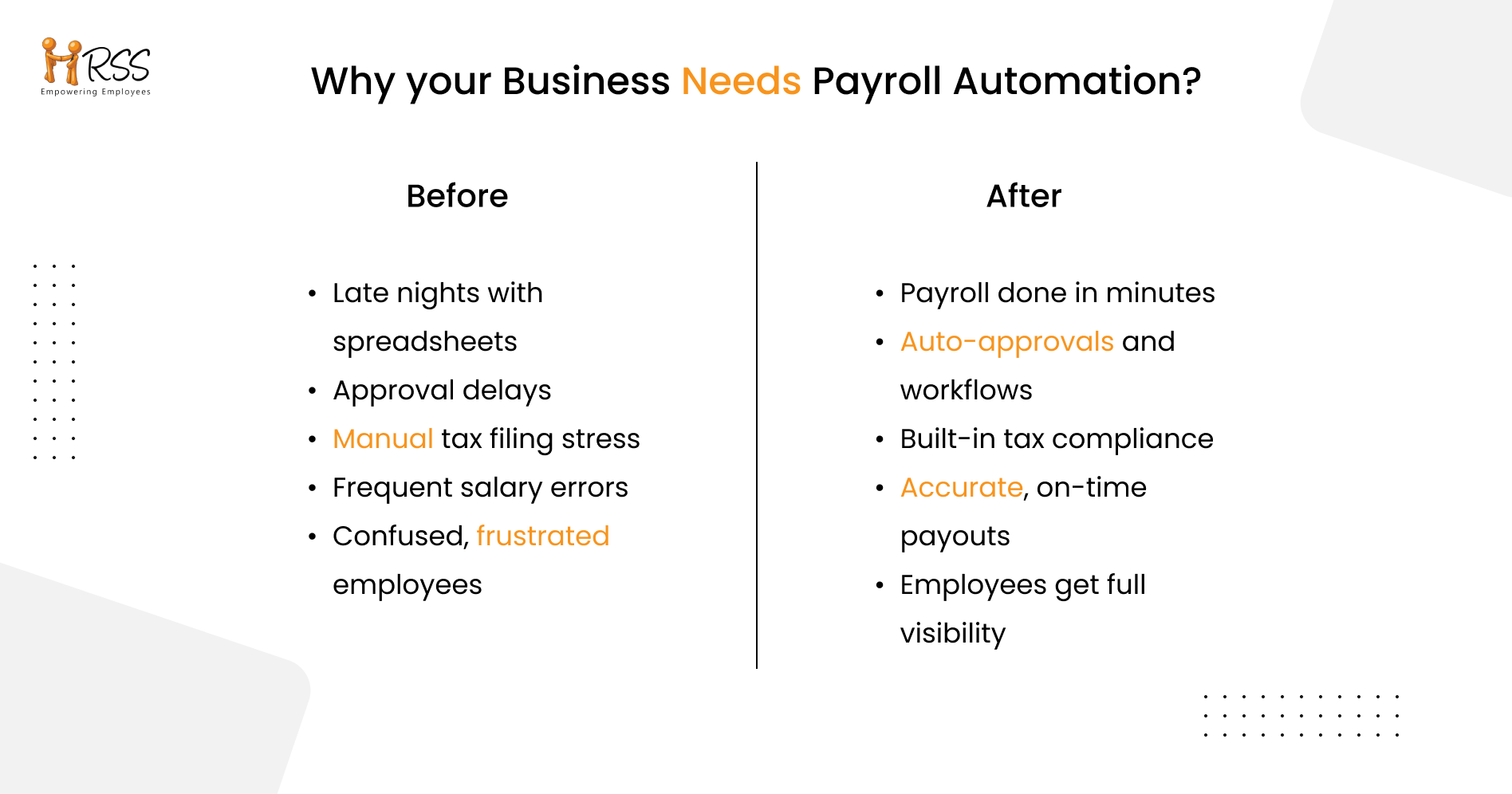

Why your business needs it?

Manual payroll may seem manageable when your team is small. But as soon as things grow or regulations change, it becomes a time-consuming and error-prone process.

Payroll automation brings consistency, speed, and peace of mind. It ensures salaries are calculated correctly, paid on time, and compliant with the latest laws. You avoid penalties. Your employees stay happy. And your team spends less time fixing errors.

It also frees up your HR and finance teams to focus on more strategic tasks instead of getting stuck in monthly chaos.

The cost of common Payroll mistakes

Payroll errors don’t just affect numbers. They affect people. And when employees lose trust in how their pay is handled, it hurts morale and retention. The most common mistakes businesses deal with include:

- Incorrect salary calculations

- Missed tax deductions

- Delayed payments

- Wrong or outdated employee data

- Compliance filing errors

An automated payroll system prevents most of these issues from happening in the first place. It calculates pay, taxes, and deductions accurately. It updates itself when tax laws change. It centralizes employee records so there are no mismatches. And it handles compliance filings on time, every time.

When you switch to automation, you don’t just fix problems, but you stop them before they start.

Why it’s time to let go the spreadsheets

Spreadsheets have been around forever, and many businesses still rely on them for payroll. But let’s be honest. They’re not built for it.

They’re slow. They’re fragile. And they don’t scale well. Even a small formula error can throw off an entire salary batch. And the more employees you have, the more room there is for something to go wrong.

Payroll automation cuts through the clutter. It reduces errors, saves hours of manual work, and keeps everything organized and secure. You no longer have to triple-check your math or worry about copying data from one sheet to another. The system does it for you, accurately and on time.

How automation helps you save big

Now let’s talk numbers. Payroll automation isn’t just about fixing errors. It helps you save time, money, and resources in the long run.

Minimize errors and improve accuracy

- Automated systems handle complex calculations like salaries, overtime, and deductions with precision.

- Less manual data entry means fewer chances of human error.

- Tax rules and salary structures are applied consistently. No need to double-check formulas.

- Systems stay updated with the latest changes, so you’re always in sync with current laws.

- Errors due to manual handling are greatly reduced, giving you peace of mind every month.

Stay compliant without stress

- Payroll systems update tax rates and statutory rules automatically.

- Accurate reports are generated for PF, ESI, TDS, and other filings.

- Timely submissions help avoid late fees and penalties.

- All records are stored and ready for audits, whenever needed.

- You don’t have to chase compliance; it becomes a part of your workflow.

Save time and free up resources

- Payroll processing time drops from days to minutes.

- Integrated time tracking ensures leave and overtime are calculated correctly.

- No more reconciling data from multiple spreadsheets or tools.

- Centralized employee data makes access fast and secure.

- HR and finance teams get more time to focus on strategy, not paperwork.

Lower operational costs

- Fewer manual tasks mean less need for extra staff or overtime.

- Administrative costs like printing, mailing, and storage are eliminated.

- Fewer errors and missed deadlines help you avoid expensive penalties.

- Resources saved through automation can be redirected to growth projects.

- Long-term, payroll automation pays for itself by increasing efficiency across the board.

What to look for in a Payroll Automation tool

Not every tool offers the same features, so it’s important to choose one that works for your business.

Look for a system that integrates with your HR and time-tracking tools. It should support statutory compliance for PF, ESI, PT, and TDS. The software should be able to transfer salaries directly to employee bank accounts and generate payslips without hassle.

A self-service portal is a must. It lets employees access their salary details and tax information without pinging HR.

Real-time dashboards, secure cloud storage, and good customer support can also make a big difference.

A better experience for your employees

Let’s not forget the people at the heart of payroll, your team. Employees want clarity. They want to know when they’ll be paid, how their salary is calculated, and what deductions apply.

With payroll automation, everything is transparent. Payslips are delivered on time. Employees can check their tax and salary details whenever they want. They don’t have to email HR every time they have a question.

That kind of visibility builds trust. And that trust boosts retention.

Let Payroll run itself

Payroll shouldn’t be a monthly fire drill. It shouldn’t keep your team up late or leave employees guessing about their pay.

With automation, payroll becomes one less thing to worry about. You get speed, accuracy, and consistency. Your employees get timely payments and transparency. And your business gets to focus on what really matters, growth, people, and culture.

So, if payroll is still a source of stress, maybe it’s time to stop doing it the hard way. Maybe it’s time to automate.

HRSS360 - your partner in smarter Payroll

If you’re ready to move on from spreadsheets and manual errors, HRSS360 is here to help.

It is more than just an automated payroll system. It is a complete HR platform designed for today’s businesses. With HRSS360, you can process payroll faster, more accurately, and in full compliance with laws like PF, ESI, and TDS.

The platform handles everything from salary transfers to payslip generation, without last-minute stress. Employees can access their information anytime through a self-service portal, which means fewer queries and more clarity.

It also integrates smoothly with your leave, attendance, and expense tracking systems, giving you one clear view of your workforce. And with clean dashboards and real-time reports, you’re always in control.

Whether you’re managing a small team or scaling across locations, HRSS360 makes payroll simple, secure, and headache-free.

If you’re ready to take the next step, let HRSS360 work for you, so you don’t have to. Connect Now!